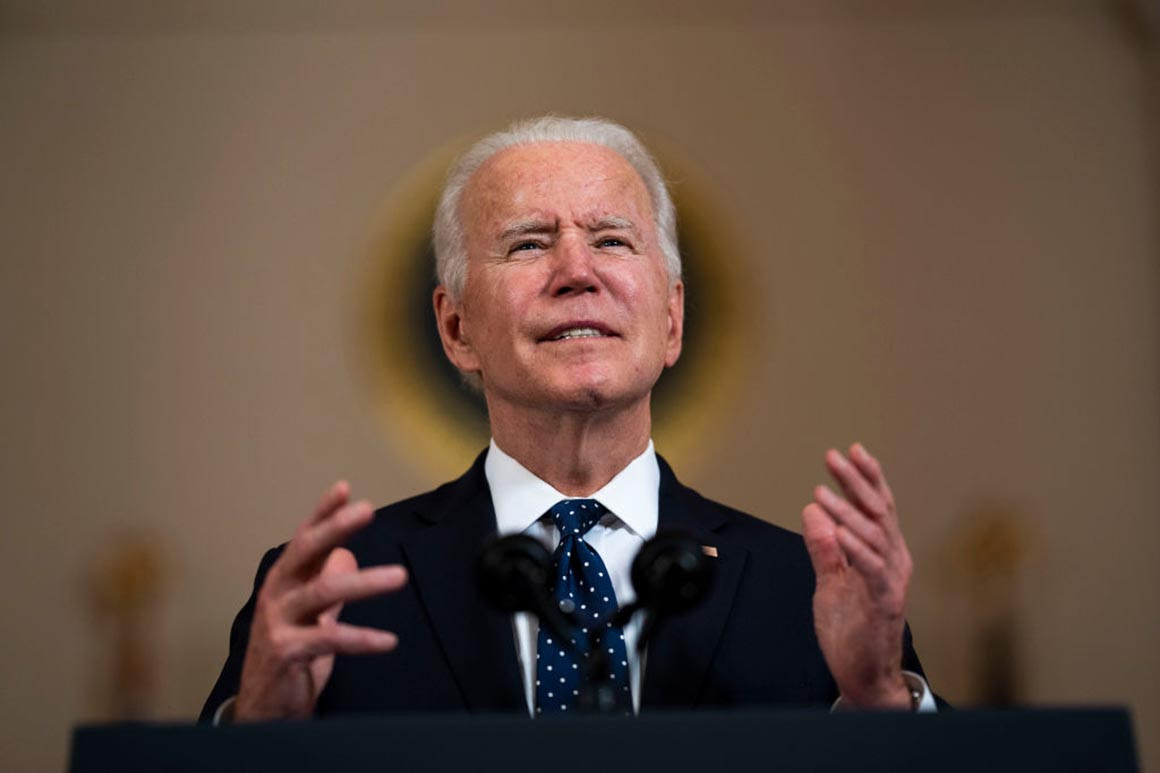

After 18 months of negotiations and a marathon night of debate, the U.S. Senate passed President Joe Biden’s central climate and health plan on Sunday, August 7, delivering a significant victory for the president less than 100 days before a crucial election.

By their votes alone, Democrats approved the plan, which includes more than $430 billion in investments and heads to the House of Representatives for a final vote next week before being signed into law by Joe Biden.

“This bill will change America for decades to come,” assured Senate Democratic leader Chuck Schumer, his voice quivering just after the vote, greeted by thunderous applause in his camp.

All the Republican senators voted against the “Inflation Reduction Act” text, which they accuse of generating useless public spending.

Senate Republican leader Mitch McConnell accused the Democrats of wanting to “double down on their economic disaster.”

The result of tough negotiations with the right wing of the Democratic Party, the package includes the largest-ever U.S. climate investment – $370 billion to reduce greenhouse gas emissions by 40 percent by 2030.

“There were a lot of trade-offs that had to be made. Doing important things almost always requires them,” Joe Biden stressed in a statement, urging the House of Representatives to pass the text without delay.

“The Senate is finally on the same page as the public in recognizing the urgency of the climate crisis,” but “in the future, more action is needed,” reacted Johanna Kreilick, president of the Union of Concerned Scientists (UCS), an NGO dealing with environmental issues, in a statement.

With this reform, the installation of solar panels will be supported at 30%, and the tax credit will go up to 7,500 USD for the purchase of an electric car.

Automakers welcome measures that “will help accelerate the conversion” of the country’s industry but lament that “tax credit requirements” make most models “ineligible,” according to John Bozzella, CEO of the Alliance for Automotive Innovation, a group of U.S. and foreign automakers representing nearly all cars sold in the United States.

“This is a missed opportunity at a crucial time” that “jeopardizes our collective goal of 40 to 50% electric vehicle sales by 2030,” he lamented.

This reform should also help strengthen the resilience of forests to fires. Several billion USD in tax credits will also be offered to the most polluting industries to assist them in their energy transition, a measure strongly criticized by the party’s left wing.

Joe Biden came to power with substantial reform projects, but saw them buried, resurrected and then buried again by a very moderate senator from his camp, Joe Manchin. The very slim Democratic majority in the Senate gives the elected official from West Virginia, a state known for its coal mines, a virtual veto power.

At the end of July, the Senate Democratic leader finally managed to wring a compromise out of Manchin.

On Saturday, August 6, senators finally began debating the text on the floor.

In the evening, they entered into a marathon procedure called “vote-a-rama”, during which, with their features drawn, they proposed dozens of amendments for fifteen hours in a row and demanded a vote on each one.

It was an opportunity for the Republican opposition, which considers the Biden plan too costly, and for the Democratic left wing, which wanted it to be broader, to present their grievances.

Bernie Sanders, an influential left-wing senator, presented several amendments intended to strengthen the social component of the text, which has been considerably cut back in recent months.

The text provides for $64 billion in investments in health care and a gradual reduction in the price of certain drugs, which are up to ten times more expensive than in other wealthy countries.

But the progressives had to abandon their ambitions for free public kindergarten and university and better care for the elderly.

“Millions of retirees will continue to have rotten teeth and not get the dentures, hearing aids or eyeglasses they deserve,” Sanders criticized from the House floor.

In parallel to these massive investments, the bill intends to reduce the public deficit with a new minimum tax of 15% for all companies with profits over 1 billion USD, to prevent some large companies from using tax loopholes that allow them to pay much less than the theoretical rate.

It is estimated that this measure could generate more than $258 billion in revenue for the US federal government over the next ten years.

Comment here