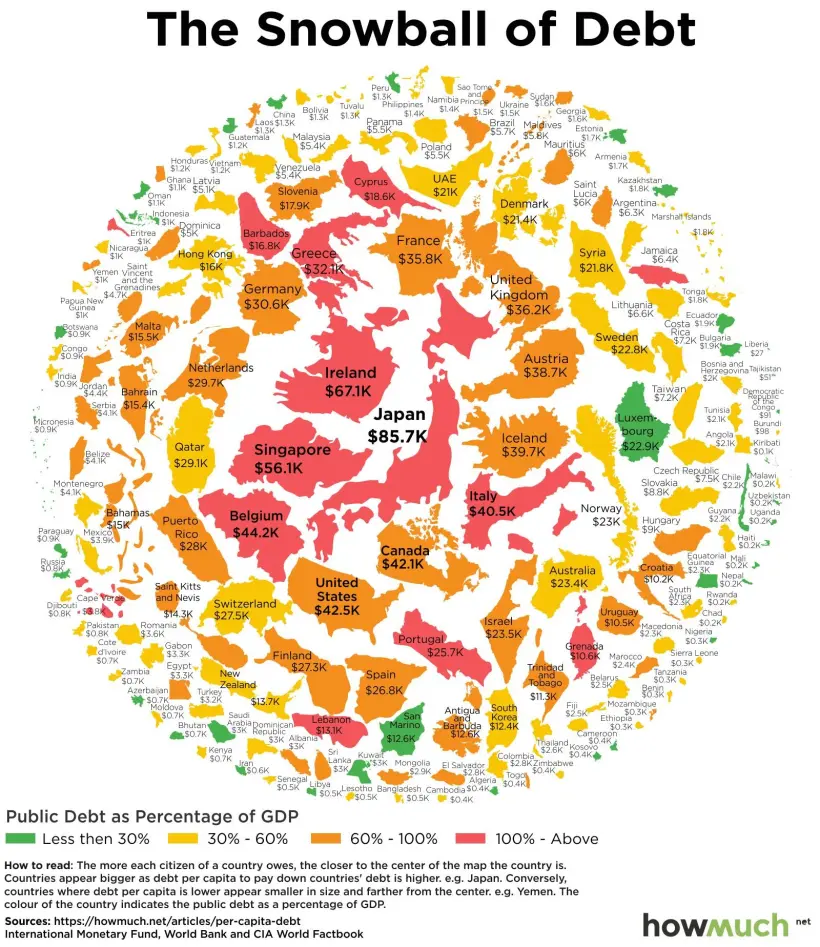

The world debt reached last year the record level of 226,000 billion dollars, or 256% of the world gross domestic product, under the effect of the crisis caused by the pandemic, announced Wednesday the International Monetary Fund. This represents an increase of 28%, the highest since World War II.

“Government borrowing accounted for just over half of this increase” also rising to a record high (99% of global GDP) while “private debt of non-financial corporations and households also reached new highs,” detailed Vitor Gaspar and Paulo Medas, IMF fiscal affairs officers and Roberto Perrelli, Fund economist in a Blog post.

Greece, already struggling with a massive debt burden, saw its borrowing rise by 25 percentage points last year, bringing its debt level to 341 billion euros, or 205.6 percent of GDP – the highest ratio in Europe relative to the size of the economy.

Italy’s debt ratio, the second-highest in the region, is 155.8% of GDP, an increase of 21.2 points from 2019. In absolute terms, Italy is the most indebted country in Europe with a debt of 2,570 billion euros.

Germany, the largest economy in the Eurozone, saw its debt increase by 10 percentage points to 69.8% of GDP and France, the second-largest economy in the bloc, recorded an increase of 18 points to 115.7% of GDP.

In the US, the debt is exploding and President Biden is ignoring the inflationary threat.

The Biden administration’s forecast for the next five years, from 2022 to 2026, calls for deficits averaging 5.9% of GDP. This level was reached only once between 1947 and 2008 – in 1983 when the unemployment rate averaged over 10 percent. However, government projections show that unemployment is expected to be 4.1 percent in 2022 and 3.8 percent from 2023.

President Biden claims that his proposals will only modestly increase the public debt (which is expected to rise anyway, mainly because of ever-increasing spending on Social Security and Medicare). But there are good reasons to believe otherwise

In the past, huge debt accumulations have usually been followed by serious problems: sluggish growth, rising inflation, financial crisis, or all of the above.

Interest rates are unlikely to be revised in the short term, the fact is that financial markets and public and private forecasters have often failed to anticipate them – for example, during the inflation of the 1970s and the disinflation of the early 1980s. After 2008, everyone grossly underestimated how long the Fed would keep its target interest rate at zero.

Of course, there will be another crisis. If the U.S. government continues to increase its debt now, the lack of fiscal capacity could hamper its policy responses when the economy really needs support. In the meantime, the deluge of debt in the advanced economies complicates the ability of poor countries, with limited debt capacity, to respond adequately to the COVID-19 crisis, compounding the human tragedy.

Comment here