The New Silk Roads are the Chinese international project called the Belt and Road Initiative. This project, which began about ten years ago, has already achieved some success, although it also involves a number of risks for China and its neighboring countries, particularly in Central Asia. According to an article published by the Russian media outlet Fergananews in 2019, economists have been able to identify the main risks associated with the development of the New Silk Roads as being corruption, debts of Chinese companies, their inability to invest, inequality, unemployment and dangers to the environment.

Analyses on the subject are limited to certain sources of information because, as Rozana Himaz of the University of Oxford noted in a study on the subject in 2018, the main economic journals, particularly Anglo-Saxon, have devoted few articles to this subject, one of the reasons identified being that the project does not present lists of the programs and actors involved. Initially, the Silk Roads were a network of routes used by caravans that reached its peak in the Middle Ages, but the discovery of maritime routes between Europe and Asia subsequently led to its decline. Initiatives to re-establish this network began in the 1950s and will eventually succeed in the 2010s.

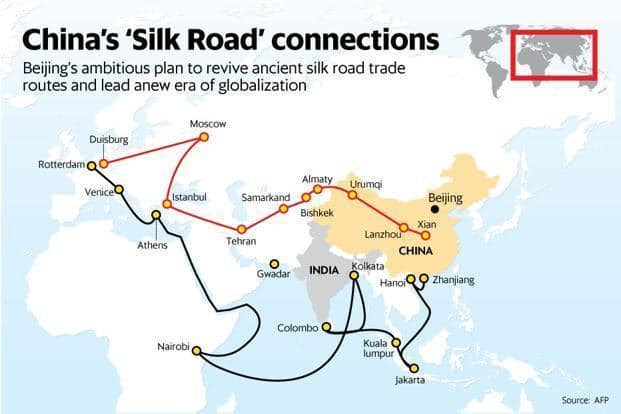

According to economists, the situation has been unblocked because of the steady rise in the cost of labor in China, which has pushed factories to move more and more to the west and the interior of the country. This, coupled with slowing economic growth, prompted President Xi Jinping to officially launch the Belt and Road Project on September 7, 2013. The new project consists of major infrastructure investments to connect China to Europe by land and China to Africa by sea. It involves about 62 countries, 32% of the world’s GDP, 39% of world trade and 63% of the world’s population and aims, in particular, to strengthen China’s energy security by reducing dependence on oil transported in particular through the Straits of Malacca. Investments are not limited to a restricted number of countries and can be opened to other partners under certain conditions, such as an increase in the flow of goods and services or cultural exchanges.

While the full list of programs involved is not known, the level of China’s investment has been communicated and amounts to four trillion dollars. Investment in port and land infrastructure to promote economic opportunities and consolidate China’s position as a global export leader could, according to economists, reduce investment costs given the size of the projects while saving money through growth in production and trade.

The room for growth appears to be significant because according to a study by researchers at Loyola University Chicago that looked at the links of the Chinese economy with its neighbors, bilateral trade and the distance between countries from the old Silk Road, trade with China is rather underrepresented. The New Silk Roads are intended to exploit this potential and overcome the export crisis that China has been experiencing in recent years. Until the 2000s, China’s economic growth and foreign investment benefited from low commodity costs, a cheap currency and a cheap labor force. But from the 2000s onwards, the yuan revalued, wages rose and domestic consumption became more attractive than exports.

Within two years of launching the project, China had invested heavily in the project’s land areas in Central Asia, Russia and Europe. According to recent studies, these investments have proven to be partly toxic as capital inefficiencies, corporate debt and corruption have undermined China’s infrastructure projects.

The new Silk Roads could end up in the same situation as real estate projects after the bursting of the speculative bubble, which has become derelict residential areas or commercial centers. It should also be noted that Chinese banks often prefer to invest in unprofitable state-owned enterprises rather than private ones and that the economic growth of projects often stops upon completion, giving way to high levels of debt, and promoting instability in the financial markets and the economy. Other states that do not have the economic power of China are also impacted, such as Sri Lanka. In Sri Lanka, for example, the construction of a new port and airport in Hambantota was a failure, leading Sri Lanka to hand over the operation of the airport to China for 99 years. Forbes magazine named it the world’s emptiest airport.

Concerning the distribution of wealth, scientists from Peking University have noted that 1% of the population owns one-third of the country’s real estate. This inequality is a direct result of the rapid growth of trade and infrastructure development over the past 20 years, as the authorities have prioritized income growth and investment over the development of social services and income distribution. These massive international investments also increase inequality in the countries where China invests. Cities along the route of the project will experience strong growth, while others will see their population decrease.

This migration of the workforce to areas of strong economic growth also leads to the weakening of outlying areas. To limit these negative effects, the states of the countries concerned must put in place regulatory mechanisms, rebalance resources and not underestimate the impact of Chinese exports on their economy. The economic development and growth born of the New Silk Roads do not target only one category of workers and also favors the employment of women. In addition to the positive aspects of this development, in some countries, such as the Philippines and Thailand, there is a shift in the burden of raising children and a decline in the level of education. On the environmental front, the New Silk Roads project requires rapid economic growth that the environmental protection legislation of the countries concerned cannot keep up with.

Each project increases the environmental risk, whether it is household and industrial waste in the South China Sea or the effects of crossing the desert and semidesert steppes of Central Asia, whose ecosystems are already suffering from water shortages and soil salinity. It is not clear how these projects will be affected by China’s efforts to tighten control over industrial infrastructure, reduce emissions and employ green technologies.

While Beijing does not need this project to consolidate its political influence over its Asian neighbours, it is necessary to avoid an economic stalemate and a slowdown in growth. Nevertheless, the risks remain high for China and if a financial crisis occurs it could contaminate neighbouring countries, as the debt is proportional to the investments made. But if it is successful, inequalities will inevitably increase between the regions that benefit from the investments and the others. For economists, it seems essential that states should be able to provide a safety net in order to limit the increase in wealth inequalities, control migration flows, ensure environmental protection, but also to strengthen education and health systems.

Comment here