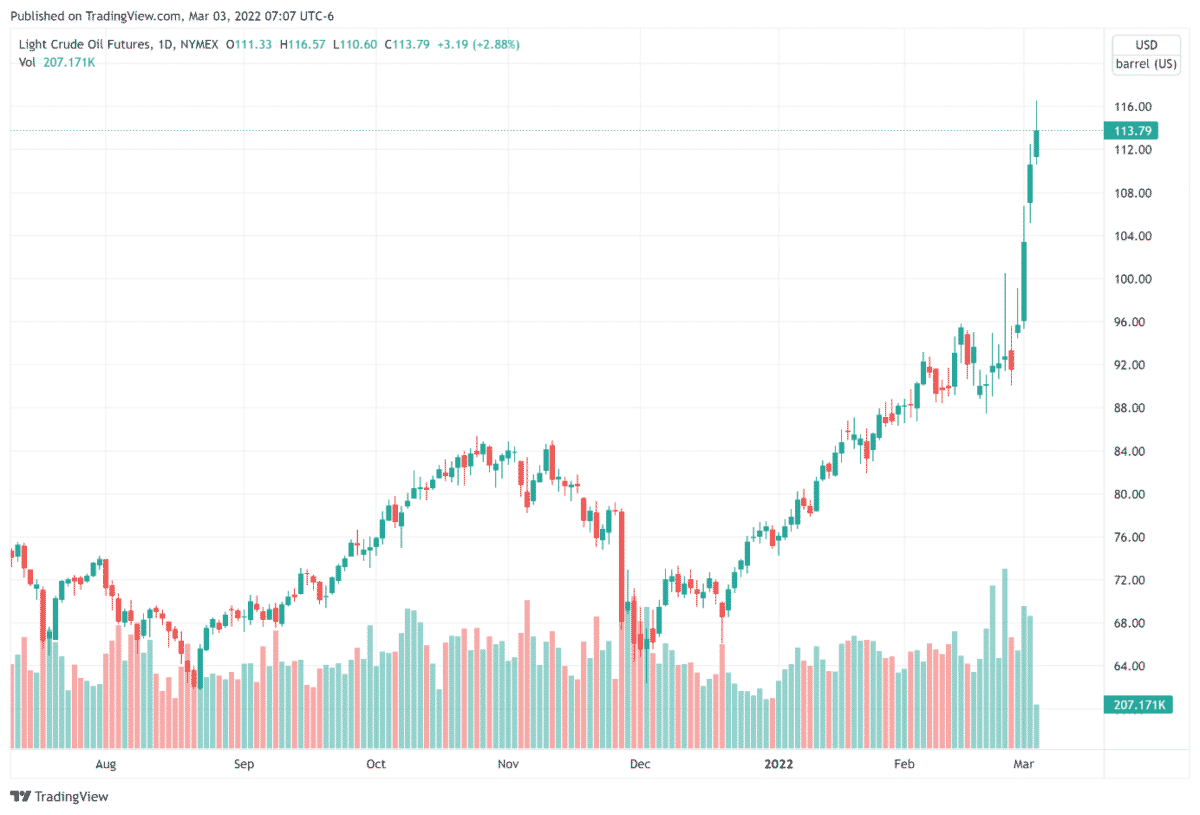

Oil prices reached record highs on Thursday, March 3, with US WTI exceeding $115 a barrel, a record since 2008, and Brent nearing $120, still boosted by uncertainties over black gold supplies in the wake of the crisis in Ukraine.

At 09:00 GMT, the barrel of Brent North Sea, the reference for crude in Europe, took 3.12% to 116.45 USD after rising to 119.84 USD. The threshold of 120 USD has not been reached since 2012.

For its part, the West Texas Intermediate (WTI) listed in New York gained 3.16% to 114.09 USD after pushing to 116.57 USD, a new high not seen since September 2008.

Anyway The price increase, explained by the crisis in Ukraine and a “risk premium” on the supply of oil from the Russian giant, is accentuated “by the uncertainty (…) and the adjustment of speculative positions”, notes Tamas Vargas, analyst at PVM.

“There are legitimate concerns about the supply tension generated by the crisis in Ukraine, and the fact that the occupier and the occupied play a key role in the global energy market,” he adds.

It should be noted that Russia is the second largest exporter of crude oil in the world.

“Even if Western sanctions” in response to the crisis in Ukraine “did not go so far as to ban Russian exports, the country’s supply of crude and oil products has clearly been affected,” especially “because financial sanctions make it impossible to purchase oil with Russia,” he points out.

Comment here